-

Corporate Finance and Deal Advisory

We offer a dedicated team of experienced individuals with a focus on successfully executing transactions for corporates and financial institutions. We offer an integrated approach, with our corporate finance specialists working seamlessly with tax and other specialists to ensure that every angle is covered.

-

Digital Risk

Grant Thornton offers solutions to the digital risk issues you are sure to face. Our skilled and experienced security team can helping by advising and consulting, giving you peace of mind, clear value for money and an enhanced ability to react to attacks.

-

Technology Consulting

Motivating and assisting our clients to pursue, maintain and secure the benefits of digital solutions is at the core of our Digital Transformation teams' agenda and goals. We work with business leaders to deliver efficient digital strategies and operating models that provide new or enhanced capabilities.

-

Economic Advisory

Our all-island Economics Advisory team combines expertise in economics and business with a wealth of experience across the public and private sectors.

-

Forensic Accounting

We have a different way of doing business by delivering real insight through a combination of technical rigour, commercial experience and intuitive judgment. We take pride in delivering responsive and tailored solutions to all our clients, capitalising on the wealth of experience housed within our Belfast and wider Forensics team

-

People and Change Consulting

The Grant Thornton People & Change Consulting practice works with clients on these issues as well as on all aspects of how they attract, retain, engage develop, deploy and lead their people.

-

Restructuring

We work with a wide variety of clients and stakeholders such as high street banks, private equity funds, directors, government agencies and creditors to implement solutions which provide the best possible outcomes.

-

Corporate and International Tax

Northern Ireland businesses face further challenges as they operate in the only part of the UK that has a land border with a country offering a lower tax rate.

-

Employer Solutions

Our team specialises in remuneration and incentive planning and works closely with employers, shareholders and employees to ensure that business strategies are aligned and goals achieved in the most tax efficient, cost-effective manner.

-

Entrepreneur and Private Client Taxes

Our team of experienced advisors are on hand to guide you through any decision or transaction ranging from the establishment of new business ventures, to realising value on exit, to succession planning and providing for loved ones.

-

Global Mobility Services

Grant Thornton offer a different approach to managing global mobility. We have brought together specialists from our tax, global payroll, people and change and financial accounting teams across Ireland and Northern Ireland, while drawing on the knowledge and insights of our global network of over 143 offices of mobility professionals to provide you with a holistic approach to managing global mobility.

-

Outsourced Payroll

Our outsourced service provides valued service to over 150 separate PAYE schemes. These ranging from 1 to 1000 employees, working for micro, SME and global employers. The service is supported by the integrated network of tax and global mobility teams and the wider Grant Thornton network delivering a seamless service. Experienced staff deliver a personal service built around your business needs.

-

Tax Disputes and Investigations

Our Tax Disputes and Investigation team is made up of tax experts and former HMRC investigators who have years of experience in dealing with a variety of tax investigations. Our expertise and insight can guide you through all interactions, keeping your cost at a minimum while allowing you to continue with the day to day running of your business.

-

VAT and Indirect Taxes

At Grant Thornton (NI) LLP, our team helps Northern Ireland businesses manage their UK and global indirect tax risks which, as transactional taxes, can quickly become big liabilities.

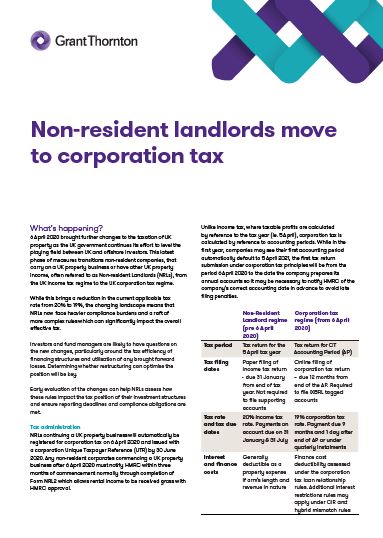

6 April 2020 brought further changes to the taxation of UK property as the UK government continues its effort to level the playing field between UK and offshore investors. This latest phase of measures transitions non-resident companies, that carry on a UK property business or have other UK property income, often referred to as Non-resident Landlords (NRLs), from the UK income tax regime to the UK corporation tax regime.

While this brings a reduction in the current applicable tax rate from 20% to 19%, the changing landscape means that NRLs now face heavier compliance burdens and a raft of more complex rules which can significantly impact the overall effective tax.

Investors and fund managers are likely to have questions on the new changes, particularly around the tax efficiency of financing structures and utilisation of any brought forward losses. Determining whether restructuring can optimise the position will be key.

Early evaluation of the changes can help NRLs assess how these rules impact the tax position of their investment structures and ensure reporting deadlines and compliance obligations are met.