Belfast Telegraph

Tariff trap on goods moving from Great Britain to Northern Ireland

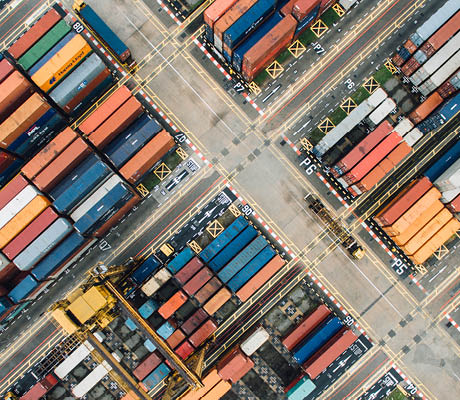

From 1 January 2021, the Northern Ireland Protocol to the Brexit Withdrawal Agreement created a customs and regulatory border down the Irish Sea.