-

Corporate Finance and Deal Advisory

We offer a dedicated team of experienced individuals with a focus on successfully executing transactions for corporates and financial institutions. We offer an integrated approach, with our corporate finance specialists working seamlessly with tax and other specialists to ensure that every angle is covered.

-

Digital Risk

Grant Thornton offers solutions to the digital risk issues you are sure to face. Our skilled and experienced security team can helping by advising and consulting, giving you peace of mind, clear value for money and an enhanced ability to react to attacks.

-

Technology Consulting

Motivating and assisting our clients to pursue, maintain and secure the benefits of digital solutions is at the core of our Digital Transformation teams' agenda and goals. We work with business leaders to deliver efficient digital strategies and operating models that provide new or enhanced capabilities.

-

Economic Advisory

Our all-island Economics Advisory team combines expertise in economics and business with a wealth of experience across the public and private sectors.

-

Forensic Accounting

We have a different way of doing business by delivering real insight through a combination of technical rigour, commercial experience and intuitive judgment. We take pride in delivering responsive and tailored solutions to all our clients, capitalising on the wealth of experience housed within our Belfast and wider Forensics team

-

People and Change Consulting

The Grant Thornton People & Change Consulting practice works with clients on these issues as well as on all aspects of how they attract, retain, engage develop, deploy and lead their people.

-

Restructuring

We work with a wide variety of clients and stakeholders such as high street banks, private equity funds, directors, government agencies and creditors to implement solutions which provide the best possible outcomes.

-

Corporate and International Tax

Northern Ireland businesses face further challenges as they operate in the only part of the UK that has a land border with a country offering a lower tax rate.

-

Employer Solutions

Our team specialises in remuneration and incentive planning and works closely with employers, shareholders and employees to ensure that business strategies are aligned and goals achieved in the most tax efficient, cost-effective manner.

-

Entrepreneur and Private Client Taxes

Our team of experienced advisors are on hand to guide you through any decision or transaction ranging from the establishment of new business ventures, to realising value on exit, to succession planning and providing for loved ones.

-

Global Mobility Services

Grant Thornton offer a different approach to managing global mobility. We have brought together specialists from our tax, global payroll, people and change and financial accounting teams across Ireland and Northern Ireland, while drawing on the knowledge and insights of our global network of over 143 offices of mobility professionals to provide you with a holistic approach to managing global mobility.

-

Outsourced Payroll

Our outsourced service provides valued service to over 150 separate PAYE schemes. These ranging from 1 to 1000 employees, working for micro, SME and global employers. The service is supported by the integrated network of tax and global mobility teams and the wider Grant Thornton network delivering a seamless service. Experienced staff deliver a personal service built around your business needs.

-

Tax Disputes and Investigations

Our Tax Disputes and Investigation team is made up of tax experts and former HMRC investigators who have years of experience in dealing with a variety of tax investigations. Our expertise and insight can guide you through all interactions, keeping your cost at a minimum while allowing you to continue with the day to day running of your business.

-

VAT and Indirect Taxes

At Grant Thornton (NI) LLP, our team helps Northern Ireland businesses manage their UK and global indirect tax risks which, as transactional taxes, can quickly become big liabilities.

During these unprecedented times for business, the Government have outlined multiple packages of support for those affected by COVID-19. Exploring these packages to secure funding should be a priority for businesses and may be the difference between the success or failure of your organisation to weather the current storm.

We appreciate that businesses may be struggling to keep up to date with the various avenues of support and may need assistance and resource to navigate through the packages available and apply for relevant funding.

The main funding supports available are summarised below:

Coronavirus Job Retention Scheme

HMRC launched the Job Retention Scheme on 20 April 2020 with claims to be paid with 6 working days. The scheme has been extended and now operates from 1 March 2020 to 31 October 2020.

HMRC originally reimbursed 80 per cent of furloughed workers wage costs up to a cap of £2,500 per month plus employer’s NIC and minimum automatic enrolment employer pension contributions on that subsidised wage.

From 1 September, the Government will pay 70% of wages up to a maximum cap of £2,187.50 for the hours the employee is on furlough. Employers will top up employees’ wages to ensure they receive 80% (up to £2,500). The caps are proportional to the hours not worked.

Wages for the purposes of this scheme includes regular obligatory payments to employees such as wages/salary, past overtime, fees and compulsory commission payments.

Discretionary bonus/tips and commission payments, non-cash payments, the cost of taxable benefits in kind or salary sacrifice arrangements reducing taxable pay should not be included.

Furloughed employees must have been on your PAYE payroll on or before 19 March 2020, notified to HMRC on an RTI submission on or before 19 March 2020 and can be on any type of contract.

Given the complexity which may be involved in calculating the amount a business is eligible for, the Government have provided guidance and examples which can be found here: https://www.gov.uk/guidance/work-out-80-of-your-employees-wages-to-claim-through-the-coronavirus-job-retention-scheme

Job Retention Bonus

The Job Retention Bonus is a one-off payment to employers of £1,000 for every employee who they previously claimed for under the scheme, and who remains continuously employed through to 31 January 2021. Eligible employees must earn at least £520 a month on average between the 1 November 2020 and 31 January 2021. Employers will be able to claim the Job Retention Bonus after they have filed PAYE for January and payments will be made to employers from February 2021.

New Job Support Scheme

From 1 November 2020, a new Job Support Scheme will be introduced for businesses with decreased demand over the winter months due to coronavirus for a period of six months. In order to qualify, employees must work at least a third of their usual hours.

The Government will pay a third of any remaining unworked hours (up to a cap of £697.92 per month) with the employer also responsible for paying a further third for unworked hours, such that an employee working the minimum 33% of their usual hours will receive 77% of their usual pay (55% paid by the employer and 22% funded by the Government). Employers are not required to have previously furloughed staff under the Job Retention Scheme.

It is designed to sit alongside the Jobs Retention Bonus and could be worth over 60% of average wages of workers who have been furloughed – and are kept on until the start of February 2021. Businesses can benefit from both schemes in order to help protect jobs.

Job Support Scheme Expansion

The Job Support Scheme is to be expanded for those Employers whose business premises are legally required to close as a result of restrictions. In order to qualify, employees must be off work for a minimum of seven consecutive days.

Under the scheme, the government will support eligible businesses by paying two thirds of each employee’s salary, up to a maximum of £2,100 a month. Employers are not required to contribute towards wages however, need to pay national insurance contributions (NICs) and pension contributions. It is expected that Employers can submit claims in December 2020.

Coronavirus Business Interruption Loan Scheme

This scheme is designed to support SMEs with access to working capital (including loans, overdrafts, invoice finance and asset finance) of up to £5m in value and for up to 10 years.

The government will pay to cover the first 12 months of interest payments and any lender-levied fees, so smaller businesses will not face any upfront costs and will benefit from lower initial repayments.

The government will provide lenders with a guarantee of 80 per cent on each loan (subject to a per-lender cap on claims) to give lenders further confidence in continuing to provide finance to SMEs.

No personal guarantees will be taken for facilities below £250,000 and there are restrictions on the amount and type of personal guarantees that lenders can take for facilities above £250,000.

The scheme is being delivered through commercial lenders, backed by the British Business Bank.

The Chancellor has now provided clarity as to the process to be adopted by banks when considering whether a business can avail of this scheme. Banks are no longer required to limit the scheme to those businesses that have initially been refused a loan on commercial or ‘business as usual’ terms. This means that all eligible businesses can now apply for the Coronavirus Business Interruption Loan Scheme with a participating lender, whether they have been refused additional facilities or not.

The Chancellor also announced an extension to the deadline for applications to 30 November 2020, availability of interest-only periods of up to six months and payment holidays.

To be eligible, the business must be UK based for its business activity and have turnover of no more than £45m per year.

We advise that you have a borrowing proposal which the lender:

- would consider viable, were it not for the COVID-19 pandemic

- believes will enable the business to trade out of any short-term to medium-term difficulty.

A business that has an existing loan with monthly repayments may want to ask for a repayment holiday to help with cash flow.

To apply for this facility, businesses should approach a participating lender to discuss their borrowing needs. Link below:

Coronavirus Large Business Interruption Loan Scheme

The Chancellor also announced a scheme to assist large businesses, which have previously been caught in the ‘stranded middle’ between the Coronavirus Business Interruption Loan Scheme and the COVID-19 Corporate Financing Facility.

This scheme is open to businesses with a turnover of more than £4m. Those businesses with a turnover of more than £45m will now be able to apply for up to £25m of finance, while those with a turnover of more than £250m can apply for up to £50m. Please note the borrower always remains 100 per cent liable for the debt.

To be eligible:

- your business must be based in the UK;

- your business must have an annual turnover of more than £45m;

- you must have a borrowing proposal which the lender would consider viable, were it not for the current pandemic, and for which the lender believes the provision of finance will enable the business to trade out of any short-term to medium-term difficulty;

- you must self-certify that your business has been adversely impacted by the coronavirus (COVID-19); and

- your business must not have received a facility under the Bank of England’s COVID Corporate Financing Facility (CCFF).

The scheme launched on 21 April 2020 and applications can be made until 30 November 2020 here: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-schemes/clbils/clbils-for-businesses-and-advisors/

It has been confirmed that the Government will provide a guarantee to the lender of up to 80 per cent for facilities under this scheme, however, these facilities will not be interest free or fee free (as they are under the Coronavirus Business Interruption Loan Scheme for SME’s).

If your business is eligible, it is recommended that you contact your lender urgently to discuss any potential application.

Bounce Back Loan Scheme

The Bounce Back Loan Scheme launched on 4 May 2020. This scheme is designed to help small to medium size businesses with loans in the range of £2,000 to £50,000, subject to a capped level equivalent to 25 per cent of business turnover.

Loans under this scheme will be 100 per cent guaranteed by government, with no capital repayments for the first 12 months and with no fees or interest to pay for that period. The applicable interest rate is 2.5 per cent per annum and loan terms will be up to 10 years.

The Chancellor announced on 24 September 2020 that the repayment structure will be converted into “Pay as You Grow”, offering a more flexible repayment system over a longer period for businesses who borrow under the Bounce Back Loan Scheme. Businesses will also be able to pay interest-only repayments for up to six months and struggling businesses will have the option to apply for BBLS payment holidays, suspending repayments altogether for up to six months.

Businesses will be liable for repayment in full of any loan advanced through the scheme.

The scheme will be delivered through accredited lenders but will not be subject to forward-looking viability checks, rather it will simply require a short self-certified online application form. It is government expectation that loans will be processed within 24 hours.

To be eligible for a loan under this scheme, your business must be based in the UK, negatively affected by coronavirus and not an ‘undertaking in difficulty’ at 31 December 2019. Applications can be made online here https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-schemes/bounce-back-loans/current-accredited-lenders-and-partners/

Note that a business cannot apply if already claiming under the Coronavirus Business Interruption Loan Scheme, though it is possible to transfer from that scheme to the Bounce Back Loan Scheme.

COVID-19 Corporate Financing Facility

Under this scheme, the Bank of England will buy short term debt from larger companies. The scheme is intended to support companies that have been affected by a short term funding squeeze, and allow them to finance short term liabilities.

Companies and their finance subsidiaries that make a material contribution to the UK economy are able to participate in the facility. They must have been in sound financial health prior to the shock – a short term or long term rating of investment grade, as at 1 March 2020, or equivalent.

Commercial paper issued by banks, building societies, insurance companies and other financial sector entities regulated by the Bank of England or Financial Conduct Authority are not eligible.

Future Fund

On 20 April 2020 the Chancellor of the Exchequer announced he is to establish a new Future Fund to support the UK’s innovative businesses currently affected by COVID-19. These businesses have been unable to access other government business support programmes, because they are either pre-revenue or pre-profit and typically rely on equity investment.

The scheme will deliver an initial commitment of £250m of new government funding which will be unlocked by private investment on a match funded basis. The government scheme, which will be developed in partnership with the British Business Bank with the intention of launching for applications in May, will initially be open until the end of September.

The Future Fund will provide government loans to UK based companies ranging from £125,000 to £5m, subject to at least equal match funding from private investors. The company must also have raised at least £250,000 in equity investment from third party investors in the last 5 years.

On 24 September 2020 the Chancellor of the Exchequer announced an extension for applications to 30 November 2020.

VAT Deferral Scheme

VAT payments for all businesses that would normally arise during the period from 20 March 2020 to 30 June 2020 will be deferred. This is an automatic deferral with no applications required, however, businesses will need to cancel their direct debit mandate if they wish to prevent the VAT liability being collected by HMRC.

Where VAT has been deferred, businesses were originally given until 31 March 2021 to pay any liabilities that have accumulated during the deferral period, with no interest/penalties being charged on the deferred amount.

VAT registered businesses that availed of the VAT deferral now have the option to repay the deferred liabilities over 11 months’ interest free instead of a lump sum on 31 March 2021. The temporary reduction in VAT for businesses in the Hospitability & Tourism sector from 20% to 5%, which was due to expire on 12 January 2021 will now be extended to 31 March 2021.

Time to Pay – HMRC

All businesses and self-employed people can be eligible to receive support with their tax affairs through HMRC’s Time to Pay service. This can allow businesses and self-employed people extended periods of time to pay outstanding amounts.

Separately, the Government has confirmed that it will be cancelling penalties and interest where you have administrative difficulties.

These arrangements are agreed on a case-by-case basis and are tailored to individual circumstances of each business. HMRC has a dedicated helpline to assist (0800 024 1222).

Property rates

The NI Executive announced an emergency £100m rates package to assist Northern Ireland ratepayers impacted by COVID-19.

For businesses, there will be a 3-month holiday for all business ratepayers (excluding public sector and utilities). This means that no rates will be charged for April, May and June 2020 and amounts to a 25 per cent discount on the annual rate bill for business ratepayers.

For domestic ratepayers, their rates bills (which were due to be issued in April 2020) will now not be issued until June 2020. Ratepayers can still choose to pay their bill in monthly instalments between June 2020 and March 2021, with monthly direct debit plans automatically updated.

The NI Executive has announced a 12.5 per cent reduction in non-domestic property rates for 2020/21.

Grants scheme

The grant scheme announced by the Northern Ireland Executive will come in two parts:

- An immediate grant of £10,000 will be provided to all small businesses who are eligible for the Small Business Rate Relief Scheme; that is all businesses with a Rateable Net Annual Value (NAV) up to £15,000; and

- An immediate grant of £25,000 will be provided to companies in the retail, tourism and hospitality sectors with a NAV between £15,000 and £51,000.

The first payments under the £10,000 Small Business Support Grant Scheme have already been made to those eligible businesses who paid their business rates by Direct Debit (as their bank details were already held by LPS). The remaining payments will be sent as soon possible after bank account details are provided through the online form.

Registration is now closed.

Localised Restrictions Support Scheme

The NI Executive will also provide financial support to local businesses which have been required to close or have had business activities at their premises curtailed. Businesses must meet the following conditions in order to apply online from 19 October 2020:

- Must operate from a property within Northern Ireland;

- Be an eligible business including café, restaurant, hotel, close contact services; and

- Must have been open to the public and trading at the start of the restriction.

Eligible businesses can claim a grant based on their Net Annual Value (‘NAV’) of their business premises, as follows:

- Property with a NAV of £15,000 or less: £1,600 for the initial two-week period and £800 for each subsequent week that the restrictions apply for;

- Property with a NAV between £15,001 - £51,000: £2,400 for the initial two-week period and £1,200 for each subsequent week that the restrictions apply for; or

- Property with a NAV over £51,001: £3,200 for the initial two-week period and £1,600 for each subsequent week that restrictions apply for.

Statutory Sick Pay (SSP)

Employers with fewer than 250 employees are now able to reclaim up to 2 weeks’ Statutory Sick Pay (SSP) per employee for sickness absence due to COVID-19, starting from the first day of sickness. Employees do not need a “fit to work note” from their GP or medical practitioner for you to make a claim.

Please note the number of employees will be determined by the number of people the business employed as of 28 February 2020. Employers should maintain the following records for at least 3 years following a claim:

- The reason why an employee could not work;

- Details of each period when an employee could not work (including start and end dates);

- Details of the SSP qualifying days when an employee could not work; and

- National Insurance numbers of all employees who have been paid SSP.

Self-employed Income Support Scheme

This scheme provides support to self-employed individuals / members of a partnership who have suffered loss of income due to COVID-19.

A taxable grant of the lower of 80 per cent of average trading profits over 3 tax years from the 2016/17 to 2018/19 tax years calculated into a monthly sum OR £2,500 per month.

First payments are expected in early June 2020.

To be eligible, individuals or members of partnerships must:

- Have submitted an Income Tax Self-Assessment tax return for 2018/19;

- Have traded in 2019/20 and be intending to continue to trade in 2020/21;

- Be trading at the time of application but for the impact of COVID-19;

- Have suffered a loss of trading profits as a result of COVID-19; and

- Have self employed trading profits of less than £50,000 and more than half their income must come from self employment.

There is an extension for the Self Employment Income Support Scheme (SEISS) Grant for the period from 1 November 2020 to 31 January 2021. This taxable grant will be paid to those that previously qualified for SEISS and will be calculated based on 20% of average monthly profits, up to a total of £1,875. An additional second grant will be available for self-employed individuals to cover the period from 1 February 2021 to 30 April 2021, however the quantum of this grant will be outlined in the coming months.

Invest NI – COVID-19 Equity Investment Fund

The Minister for the Economy announced on 8 September 2020 that Invest NI is launching a new £5 million COVID-19 Equity Investment Fund (CEIF).

CEIF will help early stage high-growth potential businesses in Northern Ireland access financing to progress their business plans and prepare for recovery and growth.

Support, up to a maximum of 50% of the funding round, is available:

- through equity investment or convertible loan notes of up to a maximum of £700,000; and

- on pari passu terms (meaning on substantially the same terms) as other investors in the funding round.

Support in excess of £700,000 may be available by way of a commercial loan.

CEIF is open to all early stage high-growth potential businesses in Northern Ireland unable to access funding after maximising investment from all other funding sources, including institutional investors, private investors, the Future Fund and Invest NI’s Access to Finance funds.

Invest NI – COVID-19 Business Planning & Financial Planning Grant

The £2m COVID-19 Business & Financial Planning Grant will support micro and SME businesses to engage an experienced consultant to carry out a review and health check of the business and develop a strategic recovery plan with financial forecasts.

The scheme will provide up to £8,000 to eligible businesses to contribute toward the cost of a consultant to undertake a business and financial review to plan for recovery.

The grant can be used towards 80% of the eligible costs of an external consultant to:

- develop a financial and business plan

- help you assess your business model

- consider options to secure the future of the business

- identify how the business will recover and grow in the longer term.

To be eligible you must be a micro or SME business which is either an existing Invest NI client, or a business operating in one of the following Standard Industrial Classification (SIC) sectors.

- Manufacturing

- Construction

- Information and Communication

- Professional, Scientific and Technical activities

Your business must also have an annual turnover of at least £500k, and have experienced a 40% reduction in turnover during the period April-June 2020.

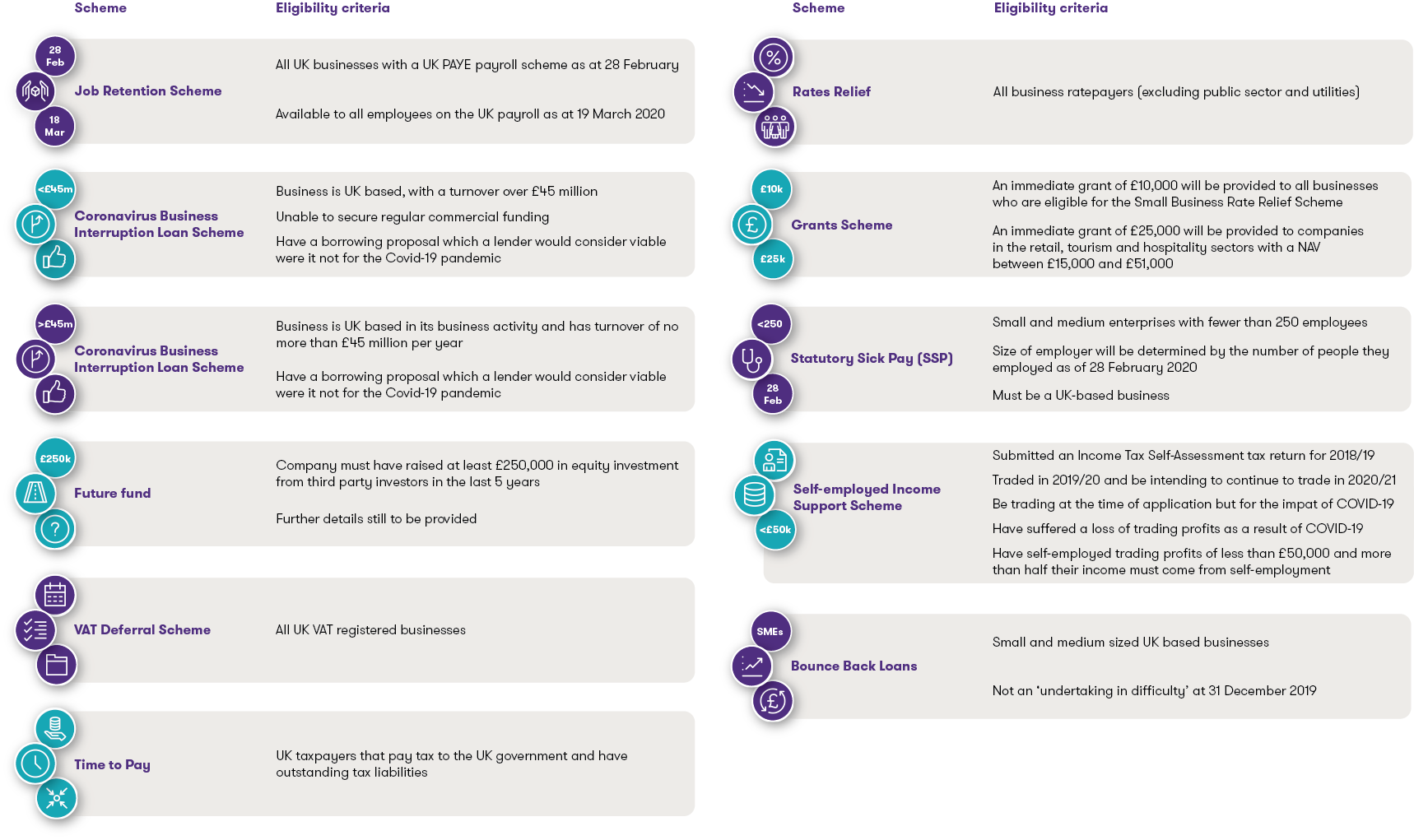

Eligibility at a glance

In addition to the Government support schemes highlighted above, businesses should not lose sight of the traditional and alternative sources of finance which would typically be available and explore all the options.

These options may include:

- Asset based lending where security is granted over a specific asset;

- Invoice discounting to fund working capital by leveraging your existing debtor book; and

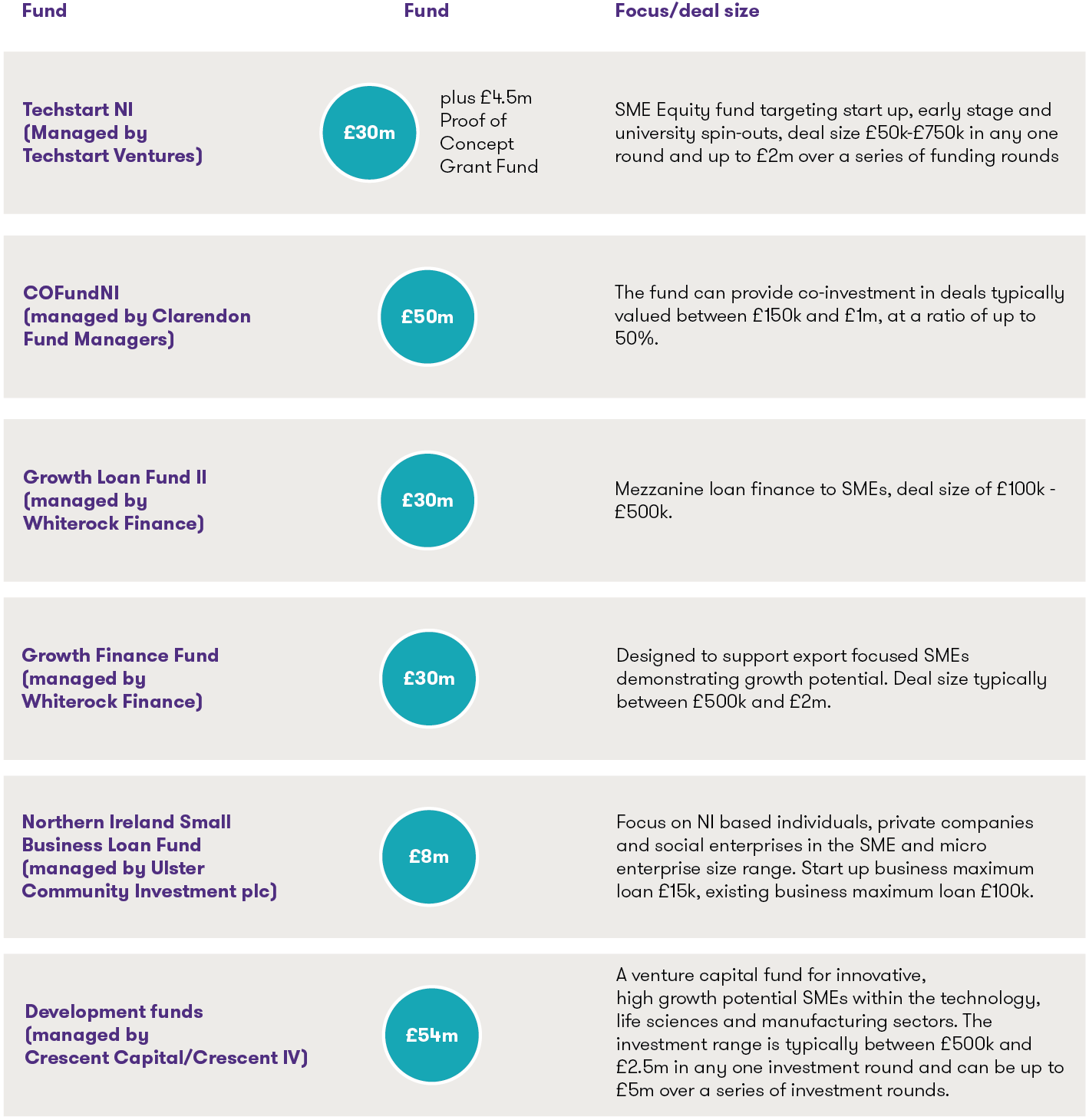

- Invest NI’s suite of funds as summarised below:

We can help navigate your way to the most appropriate package(s) of support available to your business.

We can assist across all support measures in ways including:

- Cash flow forecasting – to help assess what funding is required at what timeframes;

- Scenario planning and business case preparation – to model options, inform decisions, and prepare business cases for funding applications;

- Sounding board – to ensure your interpretation of guidelines is correct, and to challenge how government support fits into your overall plan;

- Resource to complete applications – and to deal with the necessary administration or logistics; and

- Employee engagement – helping to communicate the right messages within your organisation.

Invest Northern Ireland – Suite of funds