Fraud and Regulatory Investigations take many forms and require an open mind. They are needed when something goes wrong, an abnormality is uncovered or in instances where a review of compliance to a regulatory requirement in prescribed.

A Forensic Investigation will assist clients by establishing the facts. If a wrongdoing is suspected or alleged, a Forensic Investigation will provide evidence to help conclude on what happened. This can be a difficult time for clients. On completion, our work equips the client with knowledge required to rectify the malpractice and in some cases prevent recurrences.

Our Services

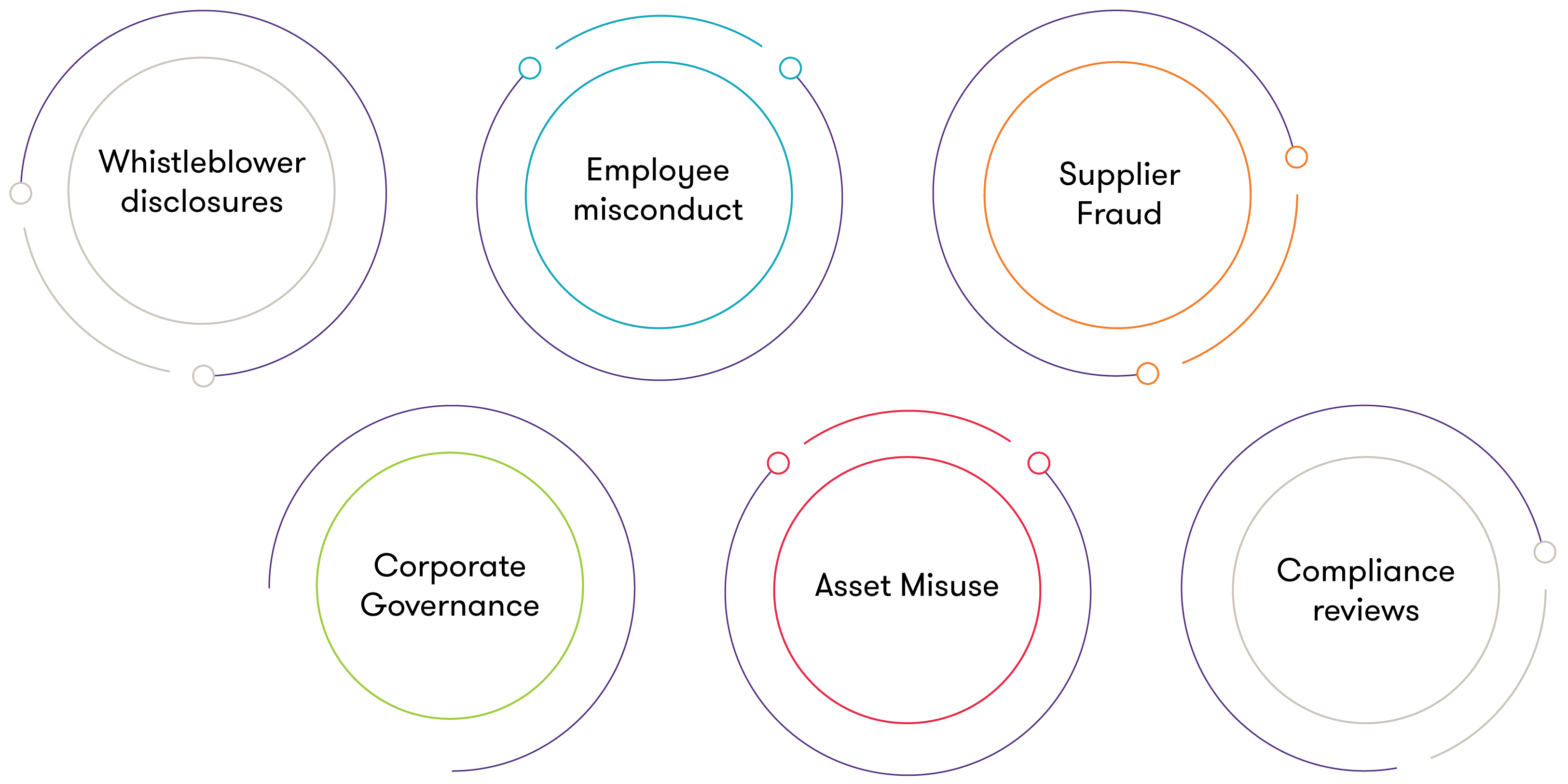

Our team of Forensic Accountants have performed hundreds of Forensic Investigations. Examples of the types of work we have performed include:

Why Grant Thornton?

We integrate digital forensics, eDiscovery and data analysis techniques into the methodologies of all investigations carried out. In addition to this, the Forensic and Investigation team work jointly with the Grant Thornton Cybersecurity team to provide clients with a full spectrum of services. We provide a wide range of services from a cyber-crisis situation to implementation of remedial solutions.

The vast experience of the Grant Thornton Forensic Accounting team is one of many differencing factors when our service offering is compared to other providers in the market. We have a lot of experience dealing with complex investigations be they small or large in nature. We have the capability of dealing with large quantities of data. We utilise forensic data analytics where possible on all projects as well as the latest digital forensic technology.

Our team of Forensic Accountants have experience with the regulatory requirements that must be adhered to and ensure the correct approach is followed to allow us to produce quality reports that are cognitive of the legal issues. This is particularly relevant in relation to whistle blower disclosures.