-

Corporate Finance and Deal Advisory

We offer a dedicated team of experienced individuals with a focus on successfully executing transactions for corporates and financial institutions. We offer an integrated approach, with our corporate finance specialists working seamlessly with tax and other specialists to ensure that every angle is covered.

-

Digital Risk

Grant Thornton offers solutions to the digital risk issues you are sure to face. Our skilled and experienced security team can helping by advising and consulting, giving you peace of mind, clear value for money and an enhanced ability to react to attacks.

-

Technology Consulting

Motivating and assisting our clients to pursue, maintain and secure the benefits of digital solutions is at the core of our Digital Transformation teams' agenda and goals. We work with business leaders to deliver efficient digital strategies and operating models that provide new or enhanced capabilities.

-

Economic Advisory

Our all-island Economics Advisory team combines expertise in economics and business with a wealth of experience across the public and private sectors.

-

Forensic Accounting

We have a different way of doing business by delivering real insight through a combination of technical rigour, commercial experience and intuitive judgment. We take pride in delivering responsive and tailored solutions to all our clients, capitalising on the wealth of experience housed within our Belfast and wider Forensics team

-

People and Change Consulting

The Grant Thornton People & Change Consulting practice works with clients on these issues as well as on all aspects of how they attract, retain, engage develop, deploy and lead their people.

-

Restructuring

We work with a wide variety of clients and stakeholders such as high street banks, private equity funds, directors, government agencies and creditors to implement solutions which provide the best possible outcomes.

-

Corporate and International Tax

Northern Ireland businesses face further challenges as they operate in the only part of the UK that has a land border with a country offering a lower tax rate.

-

Employer Solutions

Our team specialises in remuneration and incentive planning and works closely with employers, shareholders and employees to ensure that business strategies are aligned and goals achieved in the most tax efficient, cost-effective manner.

-

Entrepreneur and Private Client Taxes

Our team of experienced advisors are on hand to guide you through any decision or transaction ranging from the establishment of new business ventures, to realising value on exit, to succession planning and providing for loved ones.

-

Global Mobility Services

Grant Thornton Ireland offer a different approach to managing global mobility. We have brought together specialists from our tax, global payroll, people and change and financial accounting teams across Ireland and Northern Ireland, while drawing on the knowledge and insights of our global network of over 143 offices of mobility professionals to provide you with a holistic approach to managing global mobility.

-

Outsourced Payroll

Our outsourced service provides valued service to over 150 separate PAYE schemes. These ranging from 1 to 1000 employees, working for micro, SME and global employers. The service is supported by the integrated network of tax and global mobility teams and the wider Grant Thornton network delivering a seamless service. Experienced staff deliver a personal service built around your business needs.

-

Tax Disputes and Investigations

Our Tax Disputes and Investigation team is made up of tax experts and former HMRC investigators who have years of experience in dealing with a variety of tax investigations. Our expertise and insight can guide you through all interactions, keeping your cost at a minimum while allowing you to continue with the day to day running of your business.

-

VAT and Indirect Taxes

At Grant Thornton (NI) LLP, our team helps Northern Ireland businesses manage their UK and global indirect tax risks which, as transactional taxes, can quickly become big liabilities.

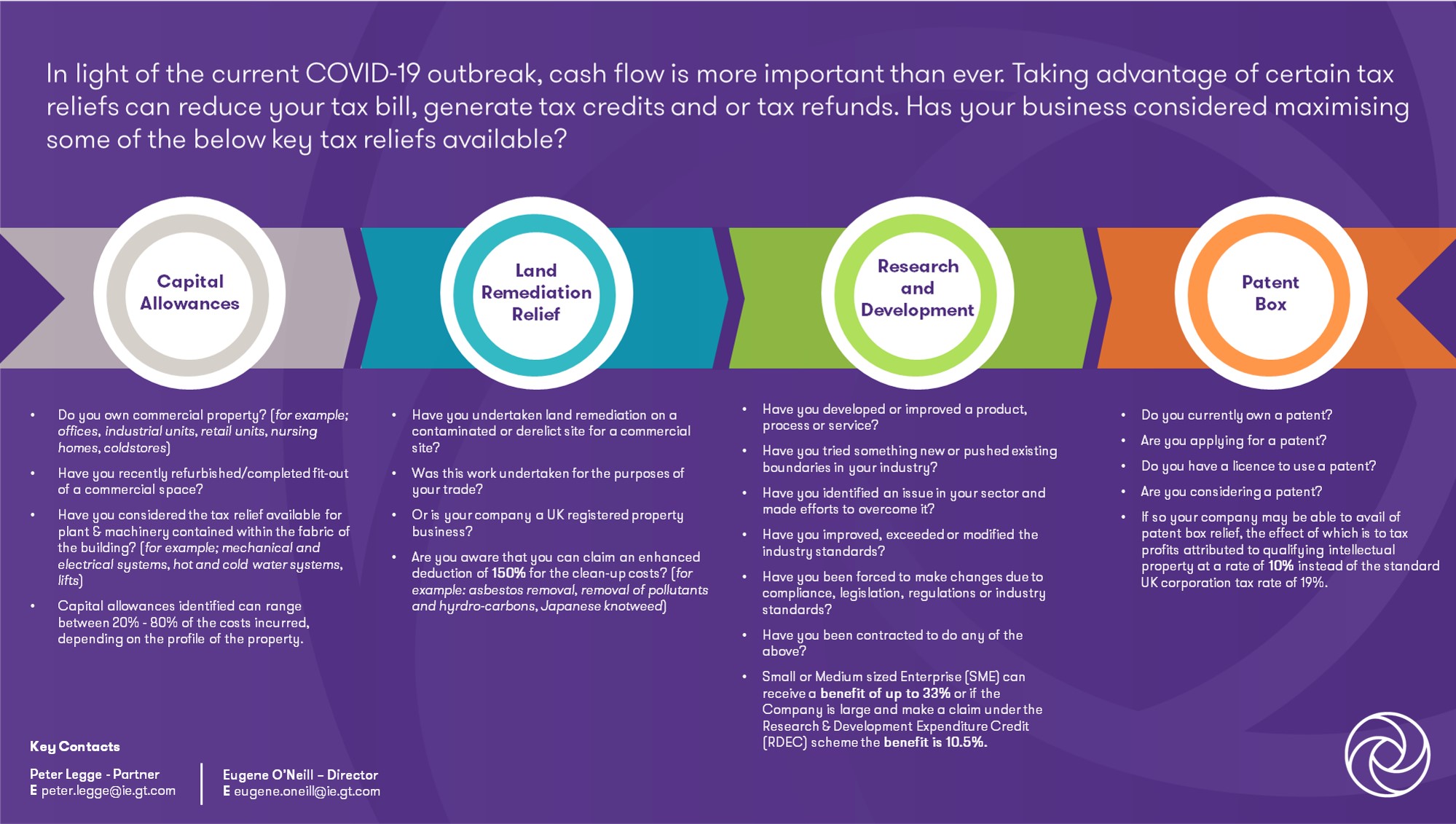

In light of the current COVID-19 outbreak, cash flow is more important than ever. Taking advantage of certain tax reliefs can reduce your tax bill, generate tax credits and or tax refunds. Has your business considered maximising some of the below key tax reliefs available?

Capital Allowances:

- Do you own commercial property?

(for example; offices, industrial units, retail units, nursing homes, coldstores)

- Have you recently refurbished/completed fit-out of a commercial space?

- Have you considered the tax relief available for plant & machinery contained within the fabric of the building?

(for example; mechanical and electrical systems, hot and cold water systems, lifts)

- Capital allowances identified can range between 20% - 80% of the costs incurred, depending on the profile of the property.

Land Remediation Relief:

- Have you undertaken land remediation on a contaminated or derelict site for a commercial site?

- Was this work undertaken for the purposes of your trade?

- Or is your company a UK registered property business?

- Are you aware that you can claim an enhanced deduction of 150% for the clean-up costs?

(for example: asbestos removal, removal of pollutants and hyrdro-carbons, Japanese knotweed)

Research & Development:

- Have you developed or improved a product, process or service?

- Have you tried something new or pushed existing boundaries in your industry?

- Have you identified an issue in your sector and made efforts to overcome it?

- Have you improved, exceeded or modified the industry standards?

- Have you been forced to make changes due to compliance, legislation, regulations or industry standards?

- Have you been contracted to do any of the above?

- Small or Medium sized Enterprise (SME) can receive a benefit of up to 33% or if the Company is large and make a claim under the Research & Development Expenditure Credit (RDEC) scheme the benefit is 10.5%.

Patent Box:

- Do you currently own a patent?

- Are you applying for a patent?

- Do you have a licence to use a patent?

- Are you considering a patent?

- If so your company may be able to avail of patent box relief, the effect of which is to tax profits attributed to qualifying intellectual property at a rate of 10% instead of the standard UK corporation tax rate of 19%.

If any of the below questions relate to your business, please get in touch with our specialist team at Grant Thornton to see what options are available to you.